Gold Ira Services

Protect Your Wealth for Generations to Come

Add a tangible asset to your portfolio, which can help reduce overall risk and increase the chances of achieving long-term financial goals.

Should You Own A Gold IRA?

Owning gold in an IRA is a smart choice for anyone looking to diversify their portfolio, protect their wealth and hedge against market volatility. By owning gold, you will add a tangible asset to your portfolio, which can help reduce overall risk and increase the chances of achieving long-term financial goals. In addition owning gold in an IRA can offer you significant tax benefits.

Don’t wait for inflation to completely devalue your dollars. Don’t give anyone else power to have control over your spending power. Now is a great time to transfer your IRA to a Gold IRA.

To Qualify As IRA Eligible Precious Metals, The Following Minimum Fineness Requirements Must Be Met:

- Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure.

- Bars, rounds and coins must be produced by a refiner, assayer or manufacturer that is accredited/certified by NYMEX, COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint and meeting minimum fineness requirements.

- Proof coins must be encapsulated in complete, original mint packaging, in excellent condition, and include the certificate of authenticity.

- Small bullion bars (other than 400-ounce gold, 100-ounce gold, 1000-ounce silver; 50-ounce platinum and 100-ounce palladium bars) must be manufactured to exact weight specifications.

- Non-proof (bullion) coins must be in brilliant uncirculated condition and free from damage.

How To Open A Gold IRA?

Talk to Our Specialists

Our team of experts will guide you through the process, answering all your questions, and ensuring a Gold IRA is the right fit for your retirement goals.

Fund Your Account

You can fund your Gold IRA with a direct transfer from an existing IRA or a 401k rollover. Our specialists will handle all the paperwork for you.

Purchase Your Gold/Silver

Once your account is funded, you can purchase gold, silver, platinum, and palladium. Our team will help you select the best precious metals for your investment needs.

Gold Prices

IRA Approved Gold

Not all gold coins, proof coins, bars, and rounds are created equal. In order to be eligible, the products must meet a specific fineness requirement of .995, with the exception of American Eagles. However, there are many qualified precious metals that can be placed in a Gold IRA. Though IRAs were once limited to only holding American Eagle products, today, IRAs include all IRS-permitted gold, silver, platinum and palladium products. Thanks to the Taxpayer Relief Act of 1997 which expanded the precious metals holdings allowed in IRAs to include one, one-half, one-quarter or one-tenth ounce U.S. gold coins and one-ounce silver coins minted by the U.S. Treasury Department, along with certain foreign coins.

At Newmont Capital you’ll never pay retail and you will always work directly with highly experienced team members. Leading industry professionals with a wealth of experience, we’ve held senior positions at the largest retail precious metals firms in the U.S. We eliminate multiple layers of executive and shareholder compensation and work directly with you to secure the most competitive pricing on gold and silver. For more information on IRA-eligible gold coins, proof coins, bars, and rounds or to learn more about rollovers, transfers, and other Gold IRA details, call Newmont Capital today 1-800-789-4171.

American Eagle Gold Four-Coin Set 2024

- Producer: West Point USA

- Weight: Various

- Content: Various

- Purity: 0.9167 fine

- Diam: Various

- IRA Eligible: Yes

The 2022 American Eagle Gold Proof Four-Coin Set features coins minted at West Point. Each contains 91.67% gold, 3% silver. After 35 years, the coin designs were updated in 2021. The set includes a one-ounce, one-half ounce, one-quarter ounce, and one-tenth ounce coin. Each is struck in 22-karat gold and expertly crafted. 100% IRA Eligible.

American Eagle Bullion / Coins

- Producer: U.S. Mint

- Weight: 31.103 g.

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 32.70 mm

- IRA Eligible: Yes

The 2022 Gold American Eagle is is struck from 1oz. of 99.99% pure gold and is the official gold bullion coin of the United States of America. First minted in 1986 and issued by the US Mint, this coin comes in four weights: one ounce, half ounce, quarter ounce, and tenth ounce.

U.S. Buffalo Bullion Coins

- Producer: U.S. Mint

- Weight: 31.103 g.

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 32.70 mm

- IRA Eligible: Yes

The American Buffalo, also known as a gold buffalo, is a 24-karat bullion coin first offered for sale by the United States Mint in 2006. This was the first time the United States Government minted pure (.9999) 24-karat gold coins for the public. this coin comes in four weights: one ounce, half ounce, quarter ounce, and tenth ounce.

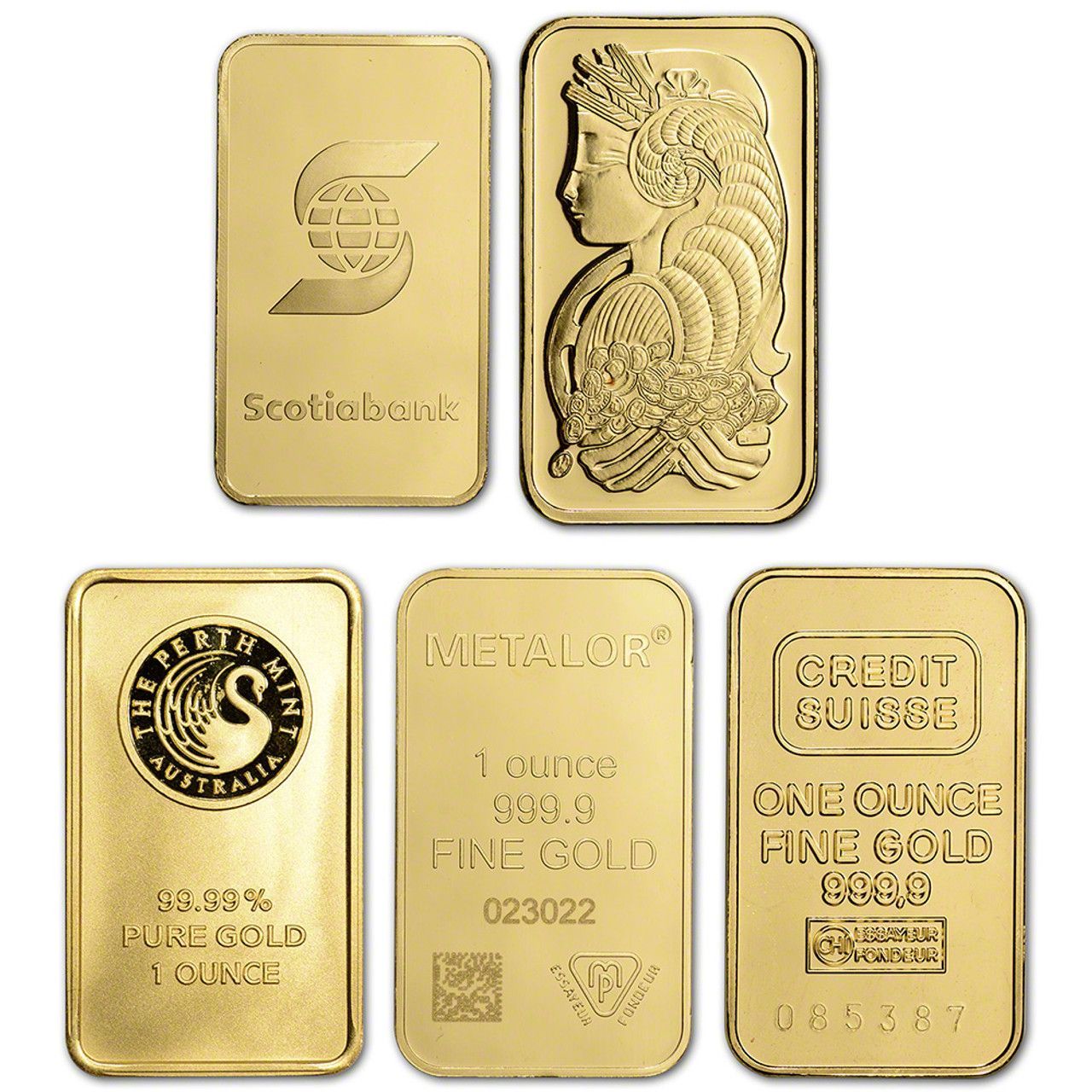

CREDIT SUISSE PAMP SUISSE BARS

- PAMP SA Company

- Weight: Various

- Content: Various

- Purity: 0.9999 fine

- Diam: Standard

- IRA Eligible: Yes

PAMP SA Company is an independently operated precious metals refining and fabricating company and member of the MKS Group. It was established in 1977 in Ticino, Switzerland. PAMP bullion bars come in various weights and sizes to suite the various needs of its owners.

1 Oz. Gold Bullion Bars (Our Choice)

- Various producers

- Weight: Various

- Content: Various

- Purity: 0.9999 fine

- Diam: Standard

- IRA Eligible: Yes

The 1 Troy oz gold bar is the most common size of gold bars and they are traded around the world, even in countries using the metric system. A Troy ounce contains 31.1 grams and is the unit of measure used for precious metals. Buying gold 1 Troy oz bars (31.1 grams), are a perfect starting point.

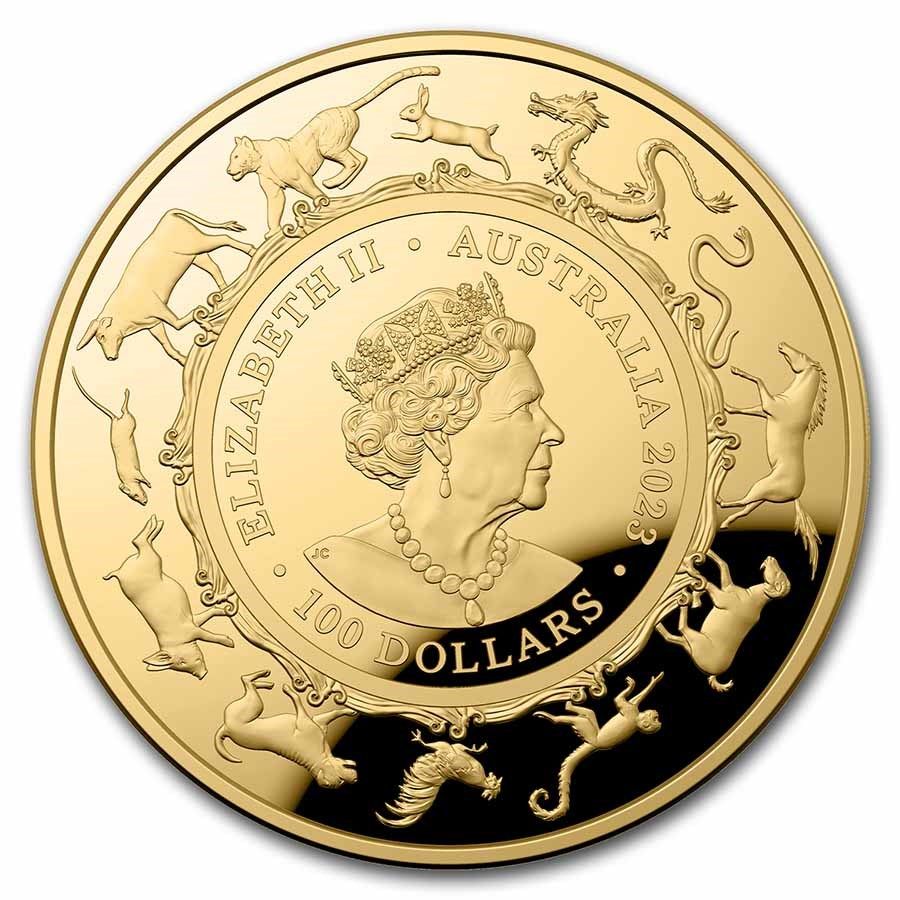

Australian Lunar Series Coin

- Producer: Perth Mint

- Weight: 131.103 g

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 32.70 mm

- IRA Eligible: Yes

The Perth Mint launched its first Silver Lunar coins in 1999. They started with their Year of the Rabbit silver coins. This was a 12 year project and coin series. The mint was impressed with the popularity of the series and so announced a second series to run from 2008 to 2019.

1/2 OZ. GOLD BRITISH SOVEREIGN COIN

- Producer: British Royal Mint

- Weight: 235 oz.

- Content: .235 Troy oz.

- Purity: 0.999 fine

- Diam: 32.05 mm

- IRA Eligible: Yes

The Great Britain Gold Sovereign is one of the most recognizable coins in the world today. The English gold sovereign has been issued since 1817 by Great Britain and bearing the portrait of the reigning monarch with each release, the gold sovereign is a historic coin that is ideal for both collecting and investing.

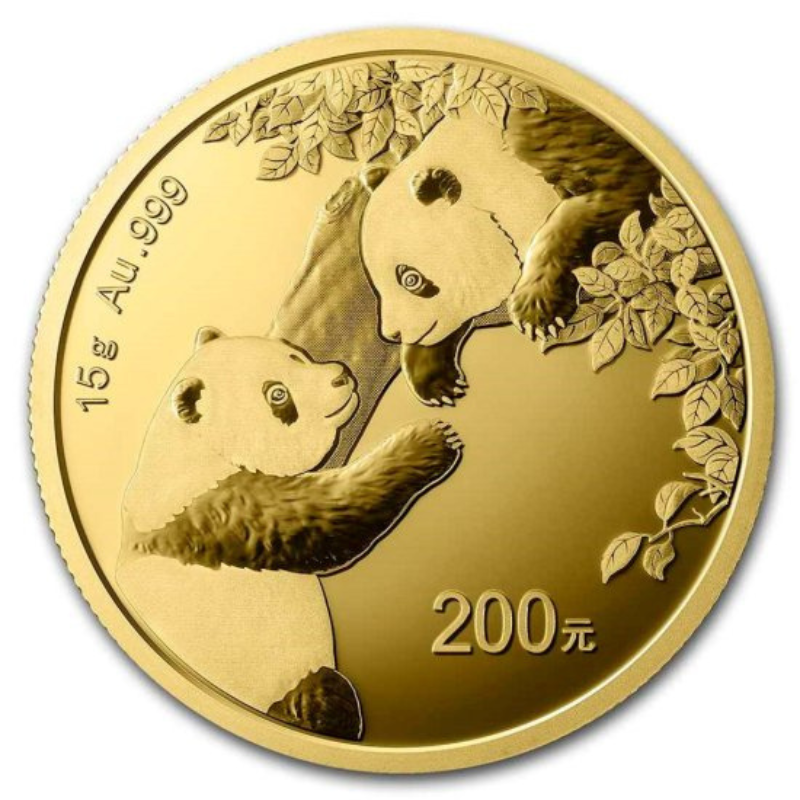

CHINESE PANDA SERIES COINS

- Producer: People’s Republic of China

- Weight: 31.103 g.

- Content: 1 Troy oz.

- Purity: 0.999 fine

- Diam: 32.05 mm

- IRA Eligible: Yes

Issued first in 1982 and produced in various sizes to satisfy demands from investors and collectors, the series continues to this day where the depiction on the coin changes with each new year. Panda coins come in different sizes and denominations, ranging from .05 to 1 troy ounce (1.6 to 31.1 grams).

CANADIAN MAPLE LEAF COINs

- Producer: Royal Canadian Mint

- Weight: 31.103 g

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 30 mm

- IRA Eligible: Yes

The Gold Maple Leaf bullion coin is struck by the Royal Canadian Mint from 1 oz. of .9999 pure gold and was first minted in 1979 to meet growing demand for investment-grade gold bullion coins. This coin features the iconic maple leaf, a symbol which is often used to represent Canada and is synonymous with Canadian identity.

BRITISH BRITANNIA COINS (2013 AND NEWER)

- Producer: British Royal Mint

- Weight: 31.103 g

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 32.69 mm

- IRA Eligible: Yes

Britannia is the female representation of Britain and has been the modern face of bullion since 1987. The history of this icon begins with her appearance on the coins of Hadrian, around AD 119, as the symbol of a new province and people. This this coin comes in four weights: one ounce, half ounce, quarter ounce, and tenth ounce.

AUSTRALIAN KANGAROO COINS

Producer: Perth Mint

Weight: 31.103 g.

Content: 1 Troy oz.

Purity: 0.9999 fine

Diam: 32.60 mm

IRA Eligible: Yes

The Australian Gold Kangaroo Coins made their debut back in 1986. Even after all these years, Perth Mint’s Kangaroo Gold Coins are still considered one of the best gold coin sets to collect. Not only do they feature a beloved Australian marsupial but they’re also indicative of the fine quality of bullion products struck by the Perth Mint.

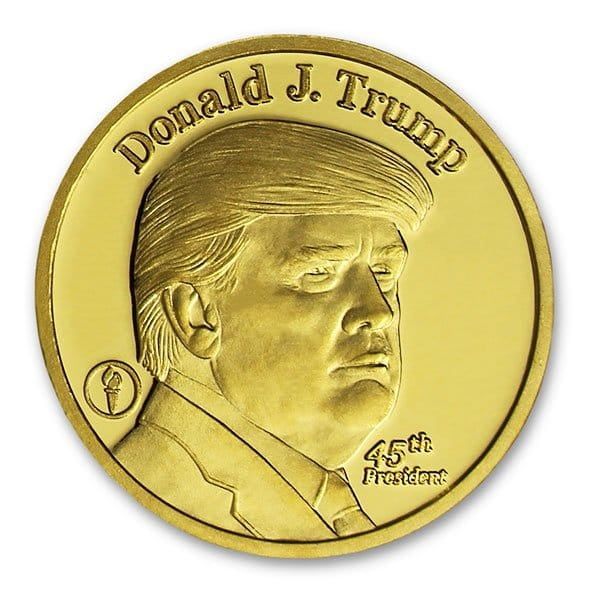

1 OZ. GOLD DONALD TRUMP ROUND

- Producer: Privately Produced

- Weight: 31.103 g.

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 32.70 mm

- IRA Eligible: Yes

These privately minted rounds are .9999 pure gold, commemorating the 45th President of the United States. The obverse features the profile of President Donald Trump. The inscription reads, “Donald J Trump” and “45th President.” The White House is pictured on the reverse.

AUSTRIAN PHILHARMONIC SERIES COINS

- Producer: Austrian Mint

- Weight: 31.103 g

- Content: 1 Troy oz.

- Purity: 0.9999 fine

- Diam: 37.0 mm

- IRA Eligible: Yes

The gold Vienna Philharmonic was first offered on October 10, 1989, and was initially minted in two sizes: one-ounce and one-quarter ounce. The one-tenth and one-half ounce coins were added in 1991 and 1994. The Vienna Philharmonic is currently the only European bullion coin with a face value in euros.

The NCG Gold IRA: A Golden Opportunity

The Newmont Capital Gold IRA (NCG Gold IRA) is a individual retirement account that allows you to invest in physical gold, silver, platinum, and palladium. It's not just about gold; it's about precious metals, offering you a broader spectrum of investment opportunities. Fill out the following form to get started with your rollover to a Gold IRA with Newmont Capital.

Top-Tier Depository Information

Newmont Capital partners with top-tier depositories to ensure the safety and security of your precious metals. These institutions are responsible for the safekeeping of your physical gold and other precious metals.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

They made understanding wealth and retirement as easy.

John D., Houston, Texas

I finally feel in control of my retirement.

Susan M., Tampa, Florida

They helped me understand that my retirement could be as solid as gold.

Linda S., New York

How a Gold IRA Benefits You?

A Gold IRA from Newmont Capital offers numerous benefits:

- Tax-Deferment: Like traditional IRAs, a Gold IRA offers tax-deferred growth. You won't pay taxes on your investment gains until you take distributions.

- Wealth Protection: Gold and other precious metals can act as a hedge against inflation and market volatility, protecting your retirement savings.

- Diversification: A Gold IRA allows you to diversify your retirement portfolio with physical assets, reducing risk.

- Control Over Your Investment: You decide what types of precious metals to include in your Gold IRA.

- Physical Assets: Unlike paper assets, gold and other precious metals have intrinsic value.

- Easy To Establish and Maintain: Our team at Newmont Capital makes the process of setting up and maintaining a Gold IRA simple and hassle-free.

- Customer Service: We pride ourselves on providing top-notch customer service. Our team is always ready to assist you with your Gold IRA needs.

Frequently Asked Questions

-

What Kind of Accounts Can I Rollover or Transfer?

You can rollover or transfer the following types of accounts into a precious metal IRA:

- Traditional IRA

- 401(k)

- 401(a)

- 403(b)

- 457(b)

- TSP

- SEP IRA

- Non-IRA investment accounts (e.g. brokerage account)

Note: The IRS rules regarding precious metal IRAs require that the precious metals held in the IRA meet certain fineness standards and be stored with an IRS-approved depository.

-

Why Do I Need a Custodian?

A custodian is required for a precious metal IRA because the Internal Revenue Service (IRS) regulations state that all self-directed IRAs, including precious metal IRAs, must be held with a custodian. The role of the custodian is to oversee the management and administration of the IRA, ensuring that all transactions and investments meet the IRS rules and regulations. The custodian is also responsible for holding the precious metals and ensuring that they are stored in an IRS-approved depository. This helps to ensure the safety and security of the assets in the IRA.

-

Why Do I Need to Use a Depository?

A depository is required for a precious metal IRA because the Internal Revenue Service (IRS) regulations state that all precious metals held in a self-directed IRA must be stored in an IRS-approved depository. The purpose of using a depository is to ensure the safety and security of the assets in the IRA, and to provide an independent third-party storage solution for the precious metals.

The role of the depository is to hold and protect the precious metals, and to provide periodic statements and valuation reports to the custodian and the IRA owner. The depository is also responsible for the proper insurance and security of the precious metals, including any necessary measures to protect against theft, loss, or damage.

By using an IRS-approved depository, the assets in the precious metal IRA are kept separate from the custodian’s own assets and are protected in the event of bankruptcy or other financial difficulties. Additionally, having the precious metals held in a depository helps to ensure that the investments meet the IRS rules and regulations for self-directed IRAs.

-

How Do I Sell My Precious Metals?

Precious metals are insured real property much like your home. However, unlike your home, which is limited to a very narrow pool of buyers, i.e. that specific property, at that specific price, in that specific zip code, etc., gold is recognized as money the entire world over. In fact, Gold is the second most traded commodity in the world after oil.

You can sell as much or as little of your precious metals to anyone, at any time, anywhere in the world. Where Newmont Capital will be happy to provide an offer to buy back your metals, you are in no way obligated to sell back to us.

-

Can I Have The Metals Sent to My House?

Absolutely! You can definitely have your precious metals delivered to your home. There are several different options and pathways to achieve this. Our experts will be happy to go through these options with you.

Start Protecting Your Future Now

Investing in a Gold IRA with Newmont Capital is more than just a financial decision; it's a decision to secure your future. Don't wait for the next market crash or inflation spike to wipe out your retirement savings. Start protecting your future now with a Gold IRA from Newmont Capital.

The statements made on this website are opinions only. Past results are no guarantee of future performance or returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same depending on a variety of factors. Newmont Capital Group cannot guarantee, and makes no representation, that any metals purchased will appreciate at all or appreciate sufficiently to make customers a profit. Newmont is a retail seller of precious metals and its buyback (or bid) prices are lower than its sell (or ask) prices. Metals must appreciate enough to account for this difference in order for customer to make a profit when liquidating the metals. Newmont does not provide financial advice or retirement planning services. The decision to purchase or sell precious metals, and which precious metals to purchase or sell, are the customer’s decision alone, and purchases and sales should be made subject to the customer’s own research, prudence and judgment.

Contact Info

Corporate Headquarters:

12100 Wilshire Blvd, Suite 800

Los Angeles, CA 90025

Wyoming Office:

2232 Dell Range Blvd, Suite 284

Cheyenne, WY 82009

Texas Office:

675 Town Square Blvd, Suite 200, Bldg 1A

Garland, TX 75040

corporate@newmontcapitalgroup.com

©2024 Newmont Capital Group, LLC. All rights reserved. Opinions on this website are not indicative of future performance. Precious metals carry risks and may vary in value. Newmont Capital Group does not guarantee profit from metal investments. Purchasing or selling decisions, based on personal research and judgment, are solely the customer's responsibility. Newmont Capital Group does not offer investment, legal, retirement, or tax advice; individuals should consult respective professionals.

Terms and Conditions · Privacy Policy · AML/Compliance and Supervisory Procedures · ADA Compliance · Risk Disclosures · Shipping and Transaction Agreement